TFSA Or RRSP? Or Both?

Aug 29, 2017

We asked Tuck Yiong, Portfolio Manager at Caldwell Securities Ltd., to explain the differences between these two types of accounts.

Tax Free Savings Accounts and Registered Retirement Savings Plans can hold various investments, including:

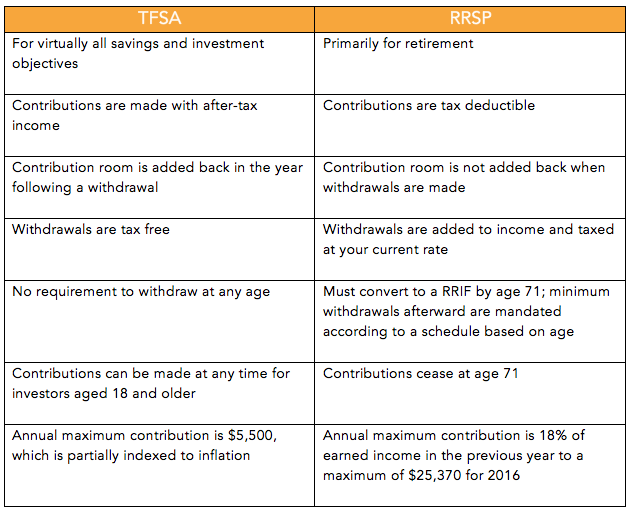

TFSAs differ from RRSPs in that any amount withdrawn from the account is automatically added back to the contribution room for the following year. Any unused contribution room can be carried forward indefinitely to future years.

TFSAs are more flexible than RRSPs, which require you to have an earned income and be under the age of 71 in order to make a contribution. Once you turn 71, your RRSPs must be converted to a Registered Retirement Income Fund (RRIF) from which you will receive regular payments.

How taxation can affect your choice

When choosing between a TFSA and an RRSP, one of the main considerations is your current and future levels of taxation.

Generally, savers who expect to have the same or lower tax rates during retirement as during their working years benefit more from the RRSP, while others would benefit more from a TFSA.

Another consideration may be your eligibility for income-tested benefits such as Old Age Security, the Guaranteed Income Supplement, Canada Child Tax Benefit, the GST/HST Credit and the Age Amount Tax Credit. Unlike income from an RRSP or RRIF, which is included when calculating these benefits, withdrawals from a TFSA do not affect the level of benefits received. It should be kept in mind that every individual faces different circumstances and financial needs.

SolarShare’s 5-Year Solar Bonds can be held in both RRSP and TFSA accounts. Find out the details here.