How Do Solar Bonds Compare With Other Investment Options?

May 22, 2018

The following is a guest blog from Jordan Lavin of ratehub.ca

How you invest your money is a very personal choice. Your investment choices might be based on your financial needs, your belief in a certain business, project or cause, your willingness to pay fees, or your tolerance to risk. Likely, all of these factor in your investing decisions.

When you invest in solar energy, it’s probably for a combination of reasons. You want to grow your money; you feel good about supporting renewable energy; and you’re confident that solar is a financially sound investment that will pay returns in more ways than one.

Solar Bonds offered by SolarShare are investments that allow you to contribute money toward the development of solar energy projects in Ontario and earn interest. There are two types of bonds available. A 5-year option pays an interest rate of 5% and returns your principal to you after the 5-year term. A 15-year option pays a 6% rate and returns your principal and interest in regular payments, much like how you would repay a loan. There are also options to hold Solar Bonds in an RRSP or TFSA to earn tax-free interest income, some of which offer compound interest.

You may be wondering how other investment options compare. Here are a few of the most common vehicles Ontarians use to invest their money, and how they compare to Solar Bonds.

High Interest Savings Accounts

You probably have one!

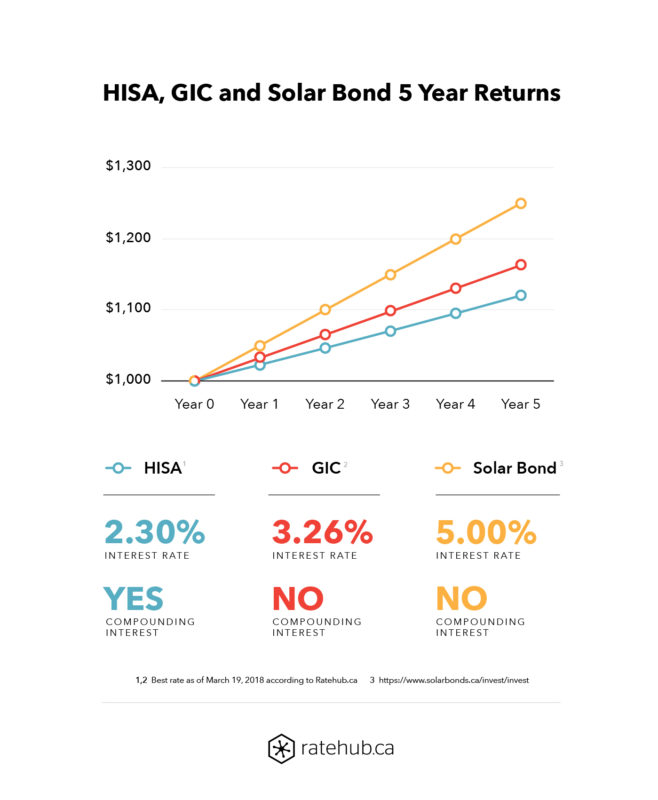

High interest savings accounts are bank accounts that allow you to save your money at a higher interest rate than regular savings accounts. The best savings accounts in Canada currently pay about 2.3% interest per year.

The best reason to invest your money in a high interest savings account is flexibility. Unlike Solar Bonds, which can’t be cashed out or sold before maturity, the money you invest in a high interest savings account is yours to use however you want, whenever you want. You can make deposits at any time, too.

There are a few downsides to high interest savings accounts. While they outperform other bank accounts in terms of interest, they don’t pay the same returns as many other investments. A 2.3% return is less than half of what your money would earn were it invested in Solar Bonds. And banks profit from your deposits by using them to fund their other investments which may not align with the types of businesses you would wish to support personally.

Guaranteed Investment Certificates (GICs)

GICs, sometimes also called term deposits, are investment products that guarantee you a certain return on investment in exchange for locking in your money for a predefined length of time. When you invest in a GIC, your money becomes inaccessible for the entire term – anywhere from one month to five years, and occasionally longer.

The best reason to invest your money in a GIC is safety. You know at the time you start a GIC exactly what your investment will be worth at maturity. And because most of Canada’s big banks are backed by the Canadian Deposit Insurance Corporation (CDIC), it’s virtually impossible for your GIC investments to fail.

Solar bonds are of comparatively low risk as they’re used to build electricity-generating solar installations where the equipment retains its value, and there are long-term contracts in place with the provincial government to ensure the projects will be profitable for the duration of the bond and long after.

The best GIC rate in Canada is currently 3.26% for a 5-year commitment. That’s less than the 5% you would earn for the same term invested in a Solar Bond. Like Solar Bonds, GICs pay simple interest, so there’s no compounding. But unlike Solar Bonds, which pay out interest regularly, you’ll have to wait until the end of your term to collect.

Market investments

Market investments are products like stocks and bonds. You can pick stocks and buy them individually, but Canadians also love to invest in products like mutual funds and ETFs, which are managed portfolios. These funds can be invested for diversity (meaning they hold as many different investments as possible), follow various indices like the S&P TSX 60, or focus on certain industries.

These kinds of investments offer lots of choice, and you can buy or sell at any time. Like Solar Bonds, you can hold them in a TFSA or RRSP. However, there are fees involved and people tend to only make good returns on these investments when they buy and hold for a long period of time – decades or more. And there’s always the risk that you could lose every dollar you invest.

Canadians can also invest in socially responsible investing (SRI) mutual funds, which consider the environment, social implications and governance when choosing which companies to include.

Like Solar Bonds, SRI funds can help you feel good about the investments you’re making, but they’re not perfect. The companies included in these funds are still beholden to their investors, and social responsibility may be merely incidental to their business. For example, financial companies like CIBC and Scotiabank fit the criteria for some SRI mutual funds, as do utilities, manufacturing, materials and even consumer brands like McDonald’s and Pepsi. In many cases, SRI mutual funds are simply doing less bad rather than doing any good.

Choose your investments wisely

No matter what your priorities are, you want to choose investments that are aligned with your needs and beliefs. Consider your ability to withdraw your money, the return on investment, tolerance to risk, time horizon, and the activity your investment is funding. Savings accounts, GICs, funds, and Solar Bonds are all good investment options, but it’s up to you to decide how best to invest your money.